Introduction

Passive income is a concept that has gained popularity in recent times. Because people look for ways to earn extra income without working every day. It continuously gives you the ability to earn money, Even when you don’t work every day. In this article, we will explore the best 25 passive income ideas in India, specially chosen for beginners who are looking for different ways to generate passive income.

Table of Contents

[ez-toc]

What is Passive Income?

Passive income is the money that you earn by doing very little things and little work. This is your income. You earn from sources like investments, rental property, or business and continue to do so, irrespective of whether you are actively working or not. The income you earn in this way is called passive income.

In simple words, passive income refers to the money you earn with minimal effort and little to no active involvement on your part. It’s the opposite of active income, where you trade your time and skills for a paycheck.

Pros of Passive Income:

- Financial Freedom

- Flexibility

- Income Diversification

- Potential for Growth

- Increased Savings and Investment Opportunities

Financial Freedom

Financial Freedom:- Passive income provides you with an additional source of income, allowing you to achieve financial independence and reduce dependence on a single source of income.

Flexibility

Flexibility:- A passive income source often requires less active involvement, giving you more flexibility in managing your time and pursuing other interests.

Income Diversification

Income Diversification:- Generating passive income allows you to have multiple sources of income, thereby reducing the risk associated with relying solely on earned income.

Cons Of Passive Income:

- Initial Investment

- Market Risks

- Lack of Control

- Time and Patience

- Ongoing Maintenance and Management

Initial Investment

Initial Investment: Many passive income sources require an initial investment of time, money, or both. It may be that there is a very good source of passive income, but you cannot do the initial investment right now. So that chance will go away.

Market Risks

Market Risks: Some passive income sources carry significant risks, such as investing in real estate or stocks, which are subject to market risks. Market volatility affects your returns and can lead to the loss of your investments.

Time and Patience

Time and Patience: It often takes some time and a lot of patience to build up a substantial passive income source. It may take some time to get big and significant returns, especially from sources like investment or business.

Best Passive Income Ideas List with Source: 2023

| S.No. | Passive Income Ideas | Source |

|---|---|---|

| 1 | Investing in Real Estate | Rental income, property appreciation |

| 2 | Rental Properties | Monthly rental income, property value appreciation |

| 3 | Peer-to-Peer Lending | Interest payments from loans |

| 4 | Dividend Investing | Dividends from stocks and shares |

| 5 | Stock Market Investments | Capital gains, dividends |

| 6 | Mutual Funds | Dividends, capital gains |

| 7 | Creating and Selling Online Courses | Course sales, membership fees |

| 8 | E-Commerce and Dropshipping | Profits from online sales, dropshipping |

| 9 | Affiliate Marketing | Commission from referred sales |

| 10 | Renting Out Your Property on Airbnb | Rental income from short-term stays |

| 11 | Creating and Monetizing a Blog | Advertising revenue, sponsored content |

| 12 | YouTube Channel and Ad Revenue | Ad revenue from YouTube videos |

| 13 | Publishing E-books | Royalties from e-book sales |

| 14 | Royalties from Intellectual Property | Licensing fees, royalties from creative works |

| 15 | Creating Mobile Apps | App sales, in-app purchases |

| 16 | Peer-to-Peer Car Sharing | Rental income from car sharing |

| 17 | Investing in Index Funds | Dividends, capital gains from index fund investments |

| 18 | Creating and Selling Digital Products | Sales of digital products, subscriptions |

| 19 | Creating and Monetizing a Podcast | Sponsorships, advertising revenue |

| 20 | Renting Out Storage Spaces | Rental income from storage units |

| 21 | High-Interest Savings Accounts | Interest earned on savings deposits |

| 22 | Cashback and Rewards Programs | Cashback, rewards, and discounts from purchases |

| 23 | Robo-Advisory Services | Passive investment management fees |

| 24 | Cryptocurrency Investments | Capital gains, staking rewards |

| 25 | Additional Source | Varies depending on individual preferences and opportunities |

Best 20 Passive Income Ideas in India: 2023

1. Creating and Monetizing a Blog

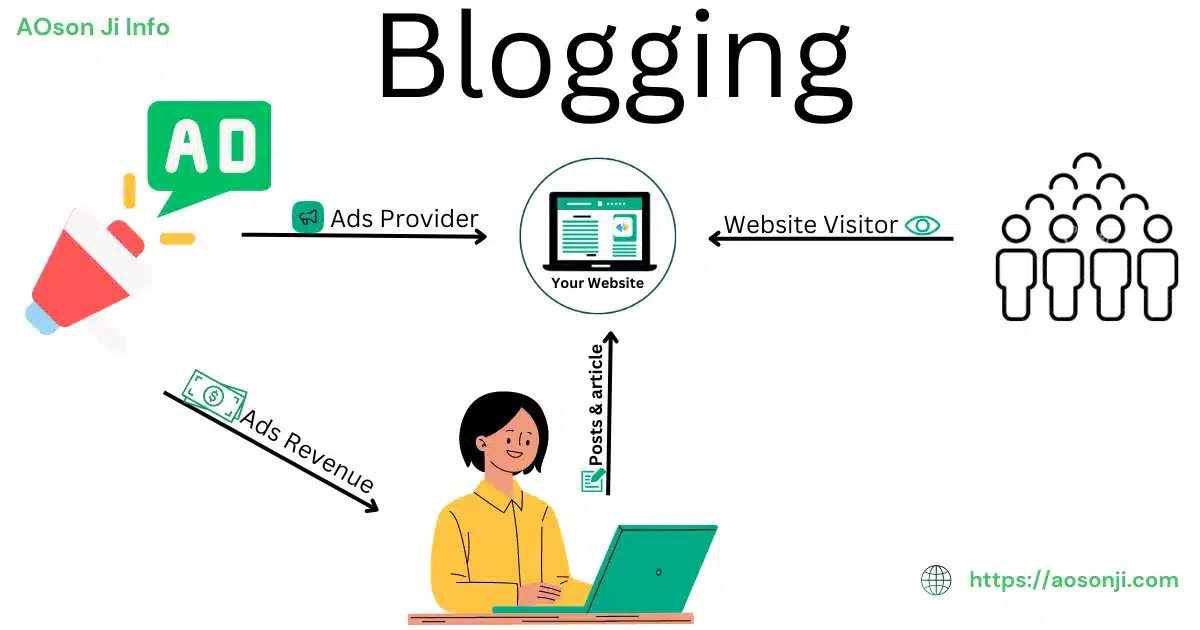

On blogging, you can share your knowledge, experience, or interests with a wide audience. By creating great quality content and monetizing your blog through ads or sponsored posts, you can earn passive income.

Read Now For Creating and Monetizing a Blog

How to Start Blogging in India – Free for Beginners 2023 – Click Here

2. Investing in Real Estate

One of the most popular ways to generate passive income is by investing in real estate. You can buy properties to earn rental income or invest in real estate investment trusts (REITs) that offer regular dividends.

3. Rental Properties

One of the most popular ways to generate passive income is by investing in real estate. You can buy properties to earn rental income or invest in real estate investment trusts (REITs) that offer regular dividends.

4. Peer-to-Peer Lending

Peer-to-peer lending platforms allow you to lend money to individuals or businesses in exchange for interest payments. It is an alternative investment option that can provide consistent passive income.

5. Dividend Investing

Investing in shares of dividend-paying companies can provide regular income in the form of dividends. Companies distribute a portion of their profits to shareholders, allowing you to earn passive income through dividends.

6. Stock Market Investments

Investing in the stock market is a great way to generate passive income. By carefully selecting the stocks of a good company and holding them for a long time, you can benefit from capital growth and dividends.

7. Affiliate Marketing

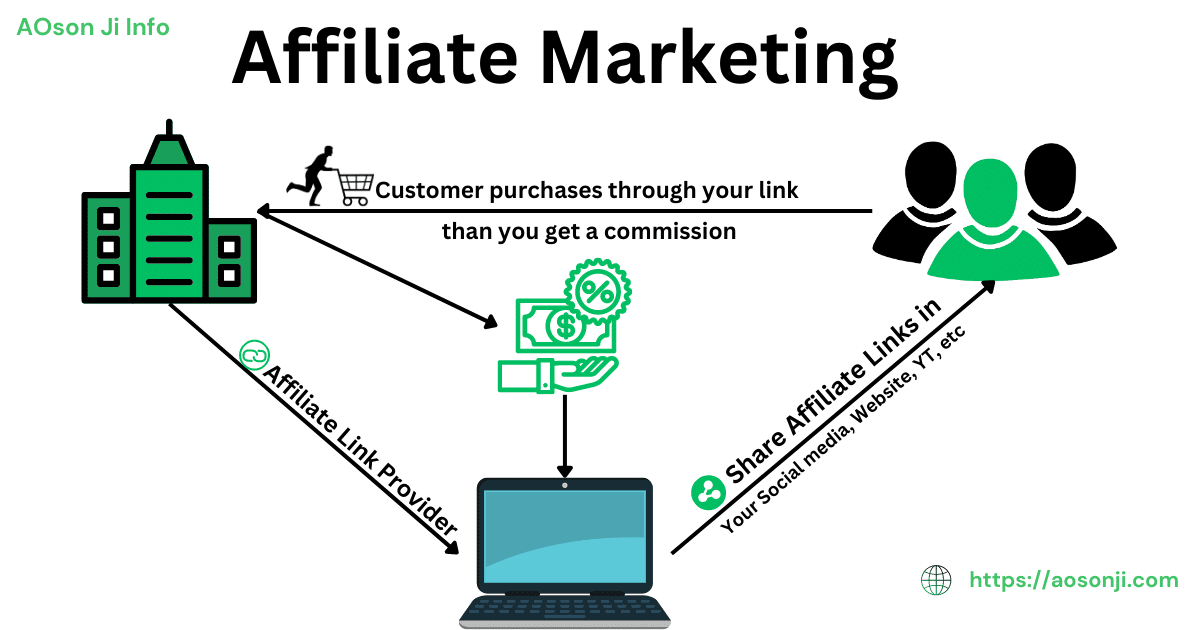

Affiliate marketing involves promoting products or services and earning a commission for each sale made through your affiliate link. By creating engaging content on social media and using your affiliate links, you can earn passive income through commission.

8. Mutual Funds

Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. Investing in mutual funds can provide passive income through dividends and capital gains.

9. Creating and Selling Online Courses

If you have expertise in a particular area, you can create online courses and sell them on platforms like Udemy or Coursera. Once a course is created, you can earn passive income as people enroll and buy your course.

10. E-Commerce and Drop Shipping

You can start an e-commerce store and generate passive income using drop shipping. You can set up an online store, source products from suppliers, and earn profits when customers shop from your website.

11. YouTube Channel and Ad Revenue

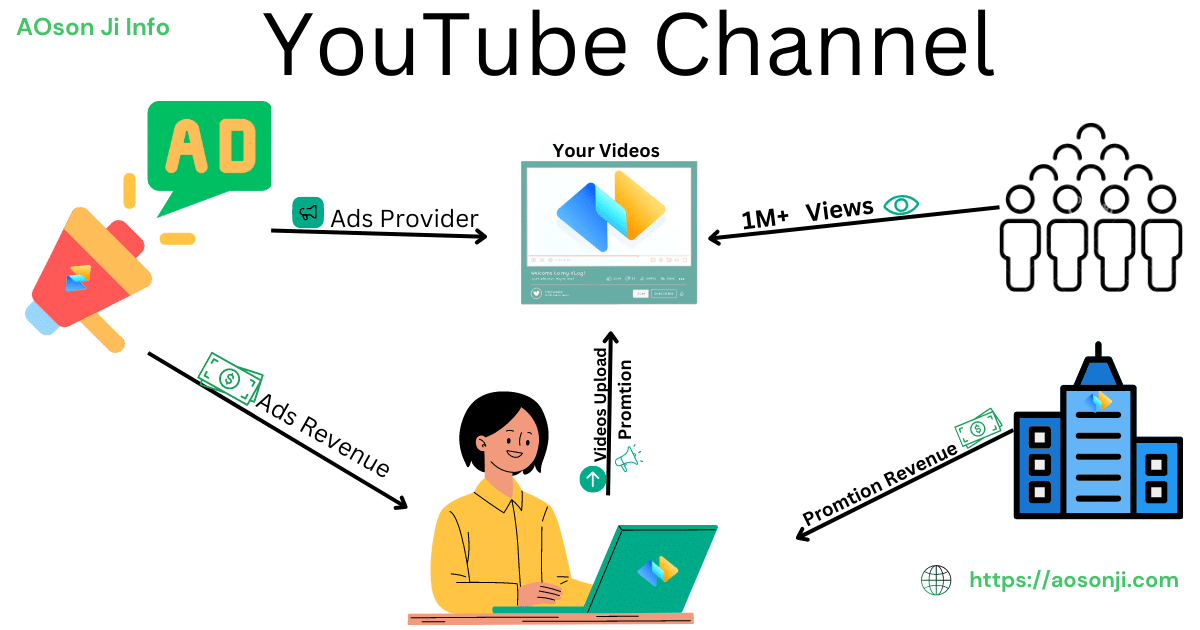

Creating a YouTube channel and publishing videos on topics that interest you is a great way to generate passive income. As your channel grows in popularity, you can earn revenue through paid sponsorships and ads displayed on your videos.

12. Renting Out Your Property on Airbnb

If you have a spare room or home, you can rent it out with the help of Airbnb to generate passive income. Many travelers do not like to stay in hotels and prefer to stay in homes rather than hotels, making Airbnb a popular platform for generating rental income.

13. Publishing E-books

If you enjoy writing and can write a great story, you can generate passive income by publishing eBooks on platforms like Amazon Kindle Direct Publishing. Once published, you will receive royalties on every sale of your e-books. generating your passive income.

14. Cryptocurrency Investments

By investing in cryptocurrencies like Bitcoin or Ethereum, you can generate passive income from their increasing value over time. However, investing in cryptocurrencies involves considerable risk. That’s why it is necessary to do deep research.

15. Royalties from Intellectual Property

If you have a creative talent like writing music, designing artwork, or inventing products, you can earn passive income through royalties. By licensing your intellectual property, you get royalties whenever someone uses it or sells it.

16. Creating Mobile Apps

Developing and monetizing mobile apps is a very profitable passive income source. You can build apps for smartphones and tablets and earn revenue through monetization (Ads), in-app sales, and in-app purchases.

17. Peer-to-Peer Car Sharing

If you own a vehicle, you can earn passive income from it through peer-to-peer car-sharing platforms. In this, you give your car for rent. With this, you can generate income from your car. when you are not using it.

18. Investing in Index Funds

Index funds are a special type of mutual fund that follows a particular market index. This allows you to earn income through dividends and capital gains without having to make individual stock selections or constantly monitor the market.

19. Creating and Selling Digital Products

You can create a digital product like a template, graphics, or software and you can sell that digital product online. Once you create a digital product, you can generate passive income by selling it over and over again.

20. Creating and Monetizing a Podcast

Starting a podcast on a topic of interest is an easy and great way to generate passive income. You can monetize your podcast through sponsorship, advertising, or offering premium content.

What is the Difference Between Earned Income, Passive Income, and Investment Income?

| Basic | Earned Income | Passive Income | Investment Income |

| Definition | Earned through active work or services | Earned with minimal effort or involvement | Returns earned from investing money |

| Source | Salaries, wages, tips, commissions | Rental income, dividends, royalties, affiliate marketing | Dividends, interest, capital gains, rental income |

| Involvement | Requires ongoing work and active involvement | Does not require constant intervention | Can be active or passive depending on involvement |

| Time Dependency | Directly tied to your time and effort | Generates revenue without constant intervention | Potential to accumulate and grow over time |

| Tax Implications | Subject to applicable income taxes | Subject to applicable income taxes | Subject to applicable income taxes |

| Recommendation | – | – | Consider consulting professionals for guidance |

Conclusion

You can achieve financial freedom with the help of passive income and create a more secure future with passive income. By diversifying your sources of income and investing wisely, you can reap the benefits of earning more money with less effort.

However, you need to know the risks and benefits of each passive income idea to know what’s best for you. Start small, be persistent, and give it your time. This will gradually develop your passive income into a great source of financial stability.

Frequently Asked Questions – FAQs

Q 1. What is passive income?

A1. Passive income refers to money earned with minimal effort and little active involvement, which comes from sources such as investments, rental properties, or businesses.

Q 2. Why is passive income important?

A 2. Passive income provides financial security and independence by reducing dependence on a single income stream, by offering an additional source of income.

Q 3. Are passive income ideas risky?

A 3. Some sources of passive income, such as investing in the stock market or real estate, carry some risk. It is essential to do extensive research and seek professional advice before investing.

Q 4. How do I get started with passive income?

A 4. Start by identifying your interests and experience. Explore passive income ideas that fit your financial capabilities and goals. Start small and gradually grow your business after gaining experience.

Q 5. What are some long-term passive income options?

A 5. Long-term passive income options include investing in dividend-paying stocks, creating digital products, and owning rental properties. These sources can provide steady income over a long period of time.

One comment

Munna kumar sing

I am read this article and it is very helpful to make an passive income and the author write all fact, problem, etc. about passive income ideas in this article. i hope this article help to make your passive income.